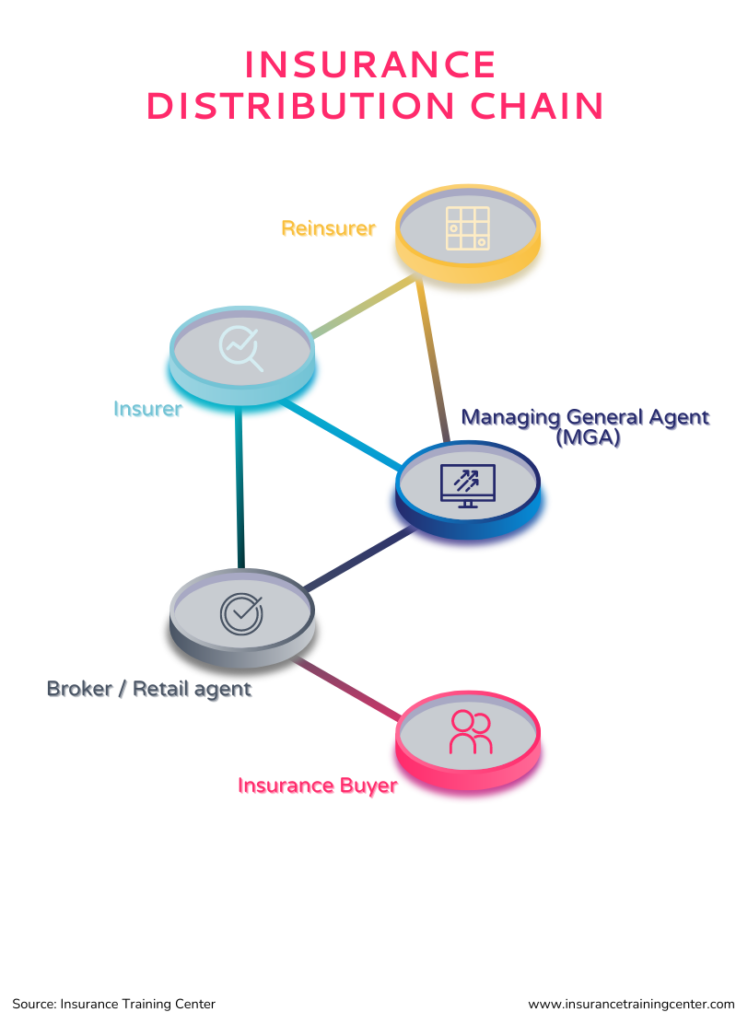

Managing General Agents (MGA) help insurers and reinsurers to grow their businesses and expand into new markets. MGAs are not insurance companies yet they do some of the work of insurance companies. They are intermediaries yet they are not insurance brokers, rather, they support insurance brokers. So what are they? Where do they fit into the insurance industry landscape? And how do they bring value to insurers, brokers, and insurance buyers?

Read the following article to find the answers.

Table of Contents Add a header to begin generating the table of contentsA Managing General Agent (MGA) is an agency that is contracted to perform various business functions, such as underwriting, binding, policy administration, claims, and distribution, on behalf of (re)insurance companies. Some MGAs specialize in a particular type of insurance or risk, for example: property, cyber, aviation, or construction. MGAs are different from insurance brokers in that the insurer has given the MGA the power to underwrite and perform various other tasks that would normally be performed by the insurer inhouse. Some MGAs are independent businesses, others, insurer-owned or broker-owned.

According to AM Best, there were 663 MGAs in the USA in 2020. And, at the time of writing, the Canadian Association of General Managing Agents and the UK’s Managing General Agents Association websites give member numbers of 65 and >300, in Canada and the UK, respectively.

The term ‘delegated authority’ refers to a contractual arrangement under which one party authorizes another party to act on their behalf. An insurer grants an MGA the authority to perform certain business functions on its behalf: underwriting, binding cover, claims handling etc. without having to obtain case by case approval from that insurer. These two parties have a ‘delegated authority relationship.’

AM Best talks about the “delegated underwriting authority enterprise” which it defines as, “a third party appointed by a (re)insurer, through contractual agreements, to perform underwriting, claims handling, and other administrative functions on behalf of its partners.” [1] The MGA is the most common form of DUAE. This category of insurance entities also includes Managing General Underwriters (MGUs), coverholders (term used in the UK, primarily with respect to the Lloyd’s market), and program administrators, among others. Note, it can be hard to distinguish the differences, and names are at times used interchangeably.

Entering a new market can require a significant investment, both in terms of money and time – dealing with local regulations, hiring staff, learning the market, putting infrastructure in place, etc. Delegating authority enables insurers to extend their reach into new geographies and specialized markets relatively quickly and with limited investment. MGAs are familiar with the business risks related to the specialized coverage they offer. They are better able to underwrite and price these policies than an insurer entering the market for the first time. Insurance companies enter into this type of outsourcing arrangement to test new products or markets, or when they consider doing so more cost effective or practical than keeping the work inhouse.

The extent, nature and parameters of the services that the MGA provides on behalf of the insurer are stipulated in the contract between the two parties known variously as a Delegated Authority or MGA Agreement.

The breadth and depth of MGA’s operations depends on the extent of the delegated authority granted by the (re)insurer. The insurer may also specify a particular line of business or set of insurance products. MGAs may contract to work for insurers and/or reinsurers.

The functions the M GA tak es on may include, but are not limited to:

Insurance brokers work for the insurance buyer delivering professional advice, sourcing insurance solutions that meet the needs of the buyer, and providing ongoing guidance and support, through claims and policy renewal. While both MGAs and brokers are intermediaries, they are really very different. For example, MGAs work for the (re) insurer whereas brokers work for the insurance buyer. And because MGAs have binding authority from their insurance partners, they can provide a totally different set of services than can other intermediaries. The following chart provides more detail on the differences between MGAs and insurance brokers.

| Managing General Agent | Insurance broker | |

| Fiduciary duty | To the insurance company | To the insurance buyer |

| Industry position | Intermediary between the insurer and the broker | Intermediary between the customer and the MGA or insurer |

| Services provided | Underwrite, price, bind cover, collect premium, claims management and settlement | Advise clients; source and negotiate suitable insurance coverage, collect premium |

| Unique knowledge | May specialize in certain risks or market sector(s) | May have industry specialization but less common. |

| Compensation | Commission from the insurer on policies sold plus profit or loss of policies they have underwritten | Commission from the insurer on policies sold |

According to a 2022 survey by Insurance Business Canada, brokers use four key criteria when looking for an MGA: (1) responsiveness, (2) pricing, (3) ability to place niche risks, and (4) product range. (see IBC survey results )

Here’s a look at how MGAs are able to deliver

USA – Wholesale and Specialty Insurance Association (formed in 2017 following the merger of the American Association of Managing General Agents and the National Association of Professional Surplus Lines Offices.)