- Do more than 20% of the dollar volume of their loans reported under the retail lending volume screen (referred to herein as “CRA lending”), including home mortgage, multifamily, small business, small farm and auto lending (if auto lending is a product line for the bank, as described in section 3 below) outside of their facility based assessment area (FBAA). CRA lending includes all lending in these categories, regardless of the borrower’s income or the income category of a census tract.

- Applies only in areas where the bank originated more than 150 closed-end home mortgage loans or 400 small business loans in both of the previous two years. (This is a significant change from an initial proposal to create RLAAs for any bank that originated 100 mortgage or 250 small business loans in the prior two years.

- For example, a $5 billion asset bank located in Cleveland would be a “Large Bank” under the rule. If all of the bank’s branches and facilities are in Cleveland proper, the bank’s FBAA would be the entire Cleveland MSA. If the bank does 30% of its CRA lending outside the Cleveland MSA and originated 200 mortgage loans in Columbus and 500 small business loans in Cincinnati in each of the last two calendar years, both the Columbus and the Cincinnati MSAs would be RLAAs.

- Intermediate and small banks opting into the Retail Lending Test will have their ORLAs assessed if they originated or purchased more than 50% of their CRA lending outside of the bank’s FBAAs.

- Even if an intermediate bank or small bank assessed under the Retail Lending Test does not meet this threshold, it may opt in to have its major product lines evaluated in the ORLAs.

3. The final rule creates new retail lending and community development tests.

Under the final rule, retail lending and community development activities are subject to two tests each, and each activity counts for 50% of a large bank’s final rating. That is a change from the rule as first proposed, which weighted retail lending and community development at 60% and 40%, respectively.

- Retail Lending Test (40% of final rating for large banks, 50% for intermediate banks and 100% for small banks that opt in.)

- The final rule sets forth a two-part Retail Lending Test to evaluate a bank’s record of meeting the credit needs of its community. First, a bank must satisfy a “retail lending volume screen” in each of its FBAAs. If a bank, other than a small bank, does not meet the retail lending volume threshold and the evaluating agency finds no acceptable basis for that failure, the bank will receive a “needs to improve” or “substantial noncompliance” on the Retail Lending Test, which will result in an overall less-than-satisfactory CRA rating. Whether a bank receives a “needs to improve” or “substantial noncompliance” on the Retail Lending Test depends on several factors, including the bank’s performance on the retail lending distribution analysis. If the bank satisfies the screen (described below), the evaluating agency will conduct the “retail lending distribution analysis” to assess the geographic and borrower distributions of each of the bank’s major product lines in each FBAA and ORLAs, and in large bank RLAAs.

- Retail Lending Volume Screen

- The retail lending volume screen compares, in each FBAA, the “bank volume metric” (the ratio of a bank’s total dollar volume of CRA lending against its deposits in the area) against a “market volume benchmark” prepared by the evaluating agency on the aggregate basis of data submitted to all three of the agencies.

- The market volume benchmark is the ratio of the aggregate volume of CRA lending by reporting banks in the FBAA divided by the annual aggregate dollar volume of market deposits in the FBAA.

- A bank satisfies the retail lending volume screen in an FBAA if its bank volume metric is 30% or greater of the market volume benchmark there.

- Example: An FBAA has an aggregate dollar volume of CRA lending of $20 million and aggregate deposits of $50 million. The market volume benchmark of this FBAA is 40%. To meet or surpass the retail lending volume screen, an individual bank’s bank volume metric must be at least 30% of 40% i.e., 12% or greater (40% x .30 = 12%).

- The bank’s dollar volume of non-auto consumer loans.

- The bank’s institutional capacity and constraints.

- The presence or lack of other lenders in the FBAA.

- Safety and soundness limitations.

- The bank’s business strategy.

- Other factors affecting the bank’s ability to lend.

- Major Product Lines

- In FBAAs and ORLAs, major product lines will consist of closed-end home mortgage loans, small business loans and small farm loans – if the particular product line comprises 15% or more of the bank’s total product lines offered in that assessment area.

- Auto loans will also be evaluated as a major product line if they make up more than 50% of a bank’s CRA lending or if the bank opts to have its auto loans assessed.

- For large banks, the evaluated product lines in RLAAs will be the product line or lines triggering the creation of the RLAA.

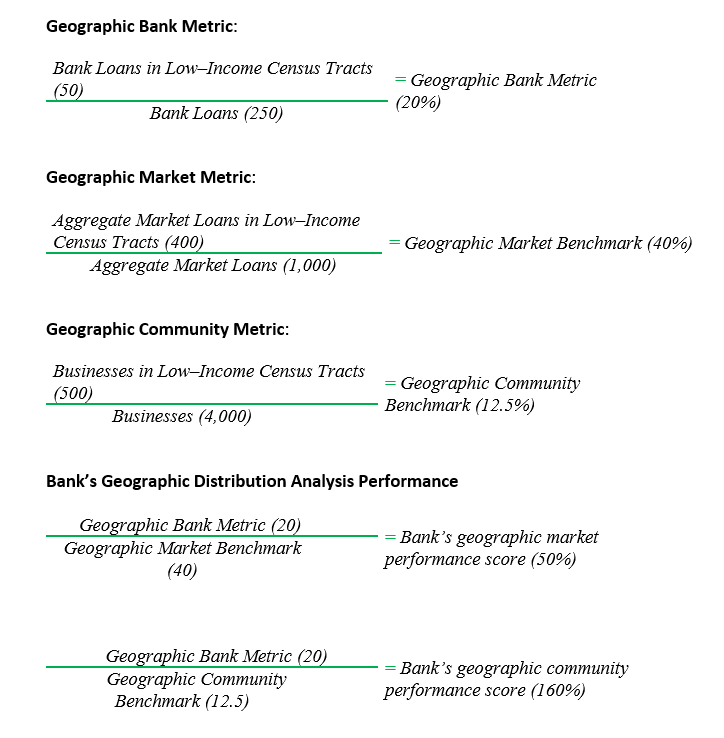

- The geographic distribution analysis will measure the “geographic bank metric” – the proportion of each major product line originated and purchased in the low- and moderate-income census tracts of an assessment area.

- Regulators will compare the bank’s geographic bank metric to benchmarks that reflect the aggregate low- and moderate-income lending of reporting banks in the assessment area as well (geographic market benchmarks) and community benchmarks that vary by product type and reflect local demographic data (geographic community benchmarks).

- The table below applies to both the geographic and borrower distribution analyses. It shows that a bank’s geographic bank metric must meet or exceed the lesser of 80% of the geographic market benchmark or 60% of the geographic community benchmark to receive at least a “low satisfactory” under the Retail Lending Test.

RETAIL LENDING DISTRIBUTION ANALYSIS PERFORMANCE RANGES

Market Benchmarks

Community Benchmarks

OR

Needs to Improve

The following equations example is sourced from Appendix A of the Final Rule. Similar metrics will be developed for home mortgage, small business, small farm and auto loans.

In this example, the bank’s geographic bank metric is 50% of the geographic market benchmark and 160% of the geographic community benchmark. Because the bank must meet or exceed either 80% of the geographic market benchmark or 60% of the geographic community benchmark threshold, the bank is not penalized by having a geographic bank metric less than 80% of the geographic market benchmark. This bank would receive an “outstanding” supporting conclusion on the geographic distribution analysis for exceeding the geographic community benchmark.

- Borrower Distribution Analysis

- For each major product line in an assessment area, the “borrower distribution analysis” will establish a metric (“borrower bank metric”) representing the percentage of a bank’s total lending, by loan count, made to:

- Low-income borrowers.

- Moderate-income borrowers.

- Businesses and farms with gross annual revenues of less than $250,000.

- Businesses and farms with gross annual revenues of greater than $250,000 but less than or equal to $1 million.

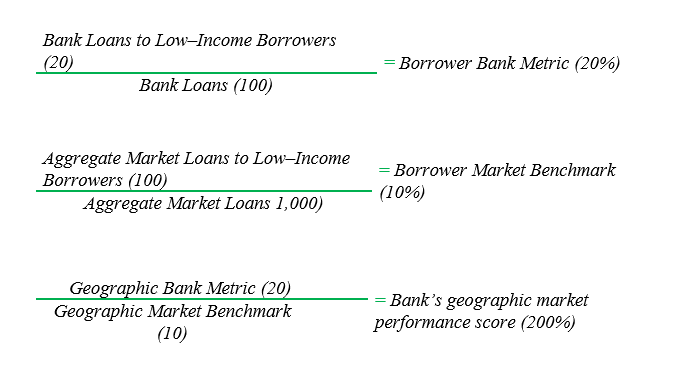

- For each major product line in an assessment area, the “borrower distribution analysis” will establish a metric (“borrower bank metric”) representing the percentage of a bank’s total lending, by loan count, made to:

Regulators will compare the bank’s lending to low- and moderate-income borrowers, small businesses and small farms to the aggregate lending of reporting banks in the assessment area for each major product line (borrower market benchmarks). They will also compare the metric to community benchmarks that vary by product type and reflect local demographic data (“borrower community benchmarks”).

An institution’s borrower bank metric must meet or exceed the lesser of 80% of the borrower market benchmark or 60% of the borrower community benchmark to receive at least a rating of “low satisfactory” under the Retail Lending Test.

A banks’ final score for the Retail Distribution Analysis will be calculated as the weighted average of each product line. The example equations below, from Appendix A of the Final Rule, demonstrate the calculation of the individual Borrower Bank Metric and the Borrower Market Benchmark for loans made to low- and moderate-income borrowers.

In this example, the bank’s borrower bank metric is 200% of the borrower market benchmark. The calculation of the borrower community benchmark would depend on the type of major product line evaluated. Regardless of its performance under the borrower community benchmark, this bank would receive a supporting conclusion of “outstanding” for exceeding the borrower market benchmark by more than 15%.

- The Retail Services and Products Test evaluates the availability and responsiveness of retail services and products, particularly to needs of low- and moderate-income customers. The evaluation of retail services considers branch availability and the responsiveness of the services provided at branches and remote service facilities.

- Banks with more than $10 billion in assets and large banks without physical branches will also be evaluated on services provided digitally, including the number of digital accounts opened and remaining active.

- Large banks operating at least one branch that do not meet the $10-billion asset threshold may opt to have their digital delivery services evaluated. Retail banking products (which includes both deposit and credit products and programs) only receive positive consideration under this test.

- The Community Development Financing Test measures the dollar volume of a bank’s combined community development loans and investments in an FBAA compared to the bank’s deposits that are sourced there. This metric is evaluated against the aggregate performance of all large banks in the FBAA. Community development financing is also evaluated at the metropolitan, nonmetropolitan, state and national level.

- The test includes a quantitative measurement of dollar volume and an impact and responsiveness review to evaluate the extent to which a bank’s community development loans and investments are impactful and responsive to community development needs. The impact review is conducted in each FBAA and, as applicable, each state, multistate metropolitan statistical area and nationwide.

The final rule sets forth 11 categories of qualifying community development activities for loans, investments and services:

- Affordable housing.

- Economic development.

- Community support services.

- Revitalization or stabilization.

- Essential community facilities.

- Essential community infrastructure.

- Recovery of designated disaster areas.

- Disaster preparedness and weather resiliency.

- Place-based services to Native Land Areas.

- Activities within minority depository institutions, women’s depository institutions, low income credit unions and community development financial institutions.

- Financial literacy.

The Fed, FDIC and the OCC will jointly issue and periodically maintain a publicly available list of examples of loans, investments and services that qualify as community development.

- Community Development Services Test (10% of a Large Bank’s Final Rating)

- The test assesses a bank’s record of providing community development services in an FBAA through a primarily qualitative analysis of the bank’s qualifying community development service activities. The evaluating agency will consider the extent and responsiveness of the activities and the service of employees as volunteers and board members in nonprofit organizations. Community development activities will also be subject to an impact and responsiveness review.

- A bank’s Community Development Services Test rating may be adjusted upward based on the consideration of community development services outside of a bank’s FBAA, but a bank is not required to provide such services outside its FBAAs.

- The test does not include a bank assessment area community development service hours metric as agencies originally proposed.

4. Strategic plans are still allowed – but appear disfavored.

Strategic plans continue to be an alternative evaluation option for all banks under the final rule. However, unlike the current rule, a bank must “justify” that its business model is outside the scope of or inconsistent with one or more of the performance tests to have a plan approved by its regulator. A bank also must show that evaluation pursuant to a strategic plan would more meaningfully reflect its record of helping meet community credit needs.

Nevertheless, a strategic plan must be based on the same performance tests that would apply in the absence of a plan. Banks using strategic plans must continue to collect and report data as they would otherwise and are subject to the same RLAA requirements as other banks.

Current regulations will continue to apply to any new strategic plan submitted to an agency for approval until November 1, 2025, and strategic plans that are currently in place will remain in force until their scheduled termination.

5. Limited purpose and wholesale banks become a single category.

The final rule revises the definition of “limited purpose bank” to encompass banks that do not extend closed-end home mortgage, small business, small farm or auto loans to retail customers. As a result, the rule includes both existing categories of limited purpose and wholesale banks.

Limited purpose banks are subject to a new Community Development Financing Test. It measures a bank’s record of meeting the credit needs of its community based on its asset size and combined dollar volume of community development loans and investments.

A limited purpose bank has the option of submitting its community development services for consideration but limited purpose banks will not be able to rely on community development services to obtain a “Satisfactory” rating. Moreover, submitting community development services for consideration is not necessary for a limited purpose bank, even to receive an “Outstanding” rating.

The limited purpose bank designation process is essentially unchanged from the current rules. Banks currently designated as wholesale or limited purpose need not reapply for designation under the final rule.

6. The final rule does not include race and ethnicity in the regulatory and supervisory framework.

The preamble to the final rule reiterates the issuing agencies’ position that the CRA and fair lending laws are “mutually reinforcing.” It rejects entreaties to adopt provisions to include race and ethnicity in the CRA regulatory and supervisory framework.

Instead, the agencies note ways the final rule benefits minorities, such as by prohibiting FBAAs from reflecting illegal discrimination, authorizing special purpose credit programs under the Equal Credit Opportunity Act (ECOA) as a responsive product under the Retail Services and Products Test and providing that a bank cannot receive community development consideration for a place-based activity that directly results in forced or involuntary relocation of low- or moderate-income individuals e.g., a bank cannot get community development consideration for financing a redevelopment of a multifamily low- and moderate-income rental building into a condominium in a “gentrifying” area. (However, banks may potentially get favorable consideration under the geographic distribution analysis of the Retail Lending Test for residential mortgage loans to high-income borrowers in low- and moderate- income census tracts.) The agencies have reaffirmed that violations of ECOA and the Fair Housing Act can be the basis of a CRA rating downgrade.

Significantly, the final rule does not include a provision that would have allowed agencies to downgrade a rating based on evidence of non-credit related discriminatory or other illegal practices. The final rule limits potential downgrades to evidence of discriminatory or illegal credit practices.

7. Most of the rule’s requirements become operative in 2026 – and banks have until Jan. 1, 2027, to comply with new reporting requirements.

Most of the final rule’s requirements, including new definitions, tests and data collection, become applicable on January 1, 2026. Banks have until January 1, 2027, to comply with new reporting requirements, with reports coming due every April 1, commencing April 1, 2027.

The final rule does not include start dates for examinations under the new scheme. It instead allows each evaluating agency to set its own policies and procedures for conducting examinations, though in no case will the new performance standards be applied prior to 2026.

Many benchmarks used to evaluate large and intermediate banks under the new tests depend on data submitted by peer banks for the same evaluation period. For the retail lending distribution analysis, the agencies plan to release the community benchmarks in advance of each calendar year and the market benchmarks after the calendar year, once reported data for that year is available. Therefore, banks will not know what their market benchmark for a passing grade is until after the evaluation period.

8. The final rule includes several notable changes to data collection and reporting requirements

Retail Loans

For home mortgage loans, large banks that are not mandatory Home Mortgage Disclosure Act (HMDA) reporters due to the location of their branches, but otherwise meet the HMDA size and lending activity requirements, must collect and maintain the mortgage loan data necessary to calculate the retail lending volume screen and distribution metrics.

The final rule also adjusts the reported gross annual revenue brackets for small business and small farm loans, eliminating the category for loans to businesses and farms earning less than $100,000. Loans will be sorted by those made to businesses and farms earning $250,000 or less, greater than $250,000 but less than $1 million, greater than $1 million, and by whether the gross annual revenues were not known by the bank.

Large banks with auto loans comprising more than 50% of the bank’s total loans in an FBAA will be required to collect and report data on these loans. All banks evaluated under the Retail Lending Test may opt to report auto lending if they wish to have that lending contribute to their rating. Specific requirements for these loans are outlined in the table below.

Retail Loan Reporting Requirements

What Type of Loan is Being Reported?

Home Mortgage Loans

Small Business and Farm Loans

Auto Loans

Who Must Report?

Large Bank HMDA Reporters

Large Bank Non-HMDA Reporters

Large Bank Majority Auto Lenders

What Information Needs to Be Reported?

Date of Loan Origination or Purchase

Loan Amount at Origination or Purchase

State, County, and Census Tract

Indicator for Business/farm revenue category

Origination or Purchase

Retail and Digital ServicesLarge banks must also collect and maintain data on the retail banking services and products they offer, including branch locations, openings and closings, hours of operation, services that are responsive to low- and moderate-income households and communities, whether a branch is full- or limited-service, or, if an ATM, whether it takes deposits, advances cash or both As discussed above under the Retail Services and Products Test, the final rule also requires large banks with assets greater than $10 billion and large banks without branches to report on their digital delivery systems, providing information on:

- The range of products offered.

- The number of checking and savings accounts opened digitally.

- The number of checking and savings accounts opened digitally that are active through the end of the year.

Data reported on retail and digital banking services will be used to determine a large bank’s score under the Retail Services and Products Test.

Deposit Data

Large banks with more than $10 billion in assets must collect and maintain county-level data on the dollar amount of deposits based on deposit location. The final rule excludes from the deposit base U.S. government deposits, state and local government deposits, domestically held deposits of foreign governments or official institutions or domestically held deposits of foreign banks or other foreign financial institutions. Deposits made by foreign individuals and companies to U.S. branches are not excluded from the deposit base.

9. A legal challenge is possible.

In a statement on the issuance of the final rule, Federal Reserve Board Governor Michelle Bowman asserted that certain changes the agencies made went beyond the scope of authority granted by Congress in the CRA. While Governor Bowman did not specify which changes she was referencing, her statement echoed banking industry concerns about RLAAs and the CRA evaluation of bank deposit products that were raised during the comment period and noted by the agencies in the preamble to the final rule.

A legal challenge, whatever the ultimate outcome, could delay implementation of the final rule beyond the rule’s transition period.

- Retail Lending Volume Screen